Do You Have to Pay the Property Tax Bill?

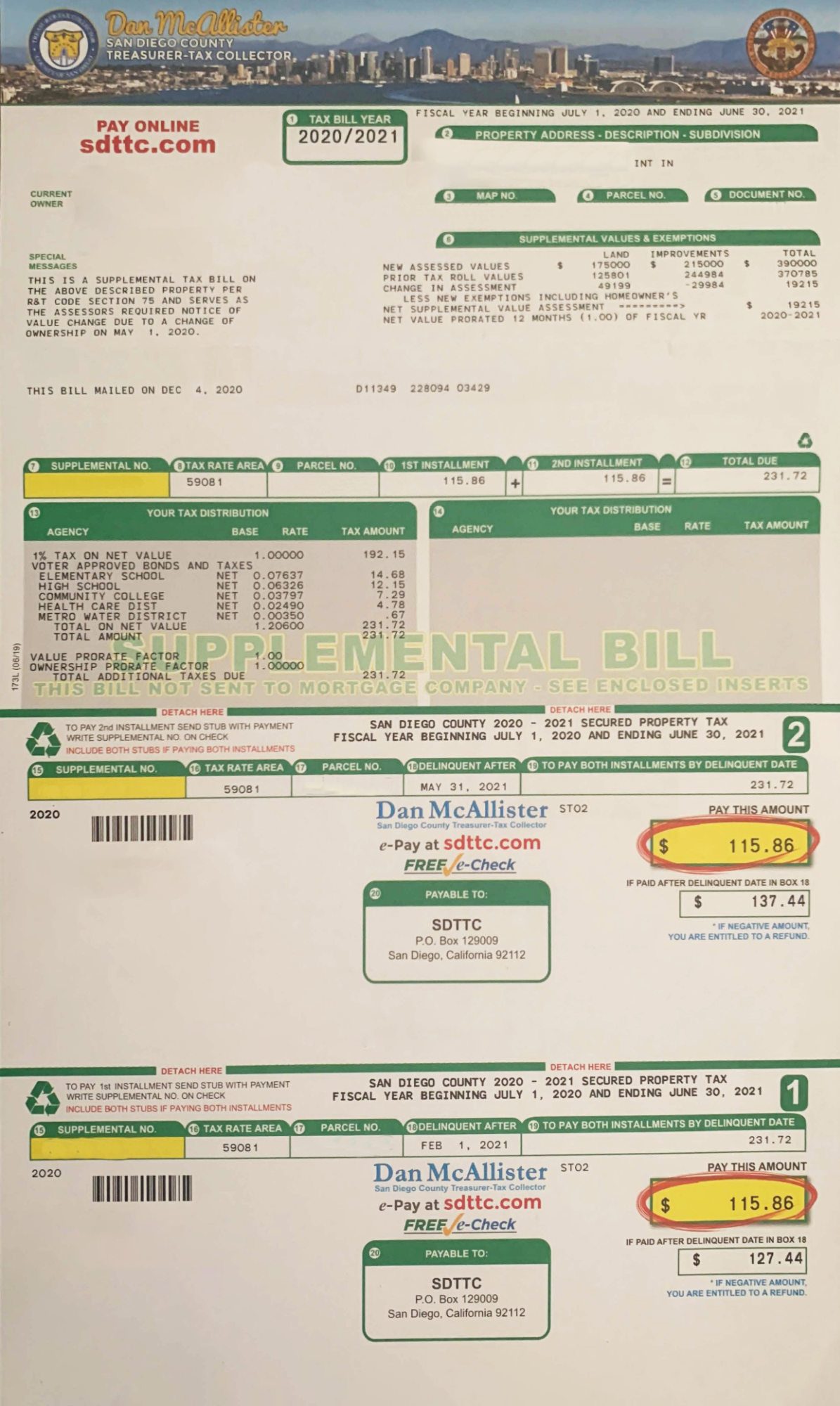

You will likely receive two tax bills in the mail if you have made a purchase in the last year, and we want to make sure it is clear which bill you are responsible for and which bill the Escrow company will pay.

*The information below does not come from a professional tax advisor. Pease always consult an attorney or tax professional regarding your specific legal or tax situation.

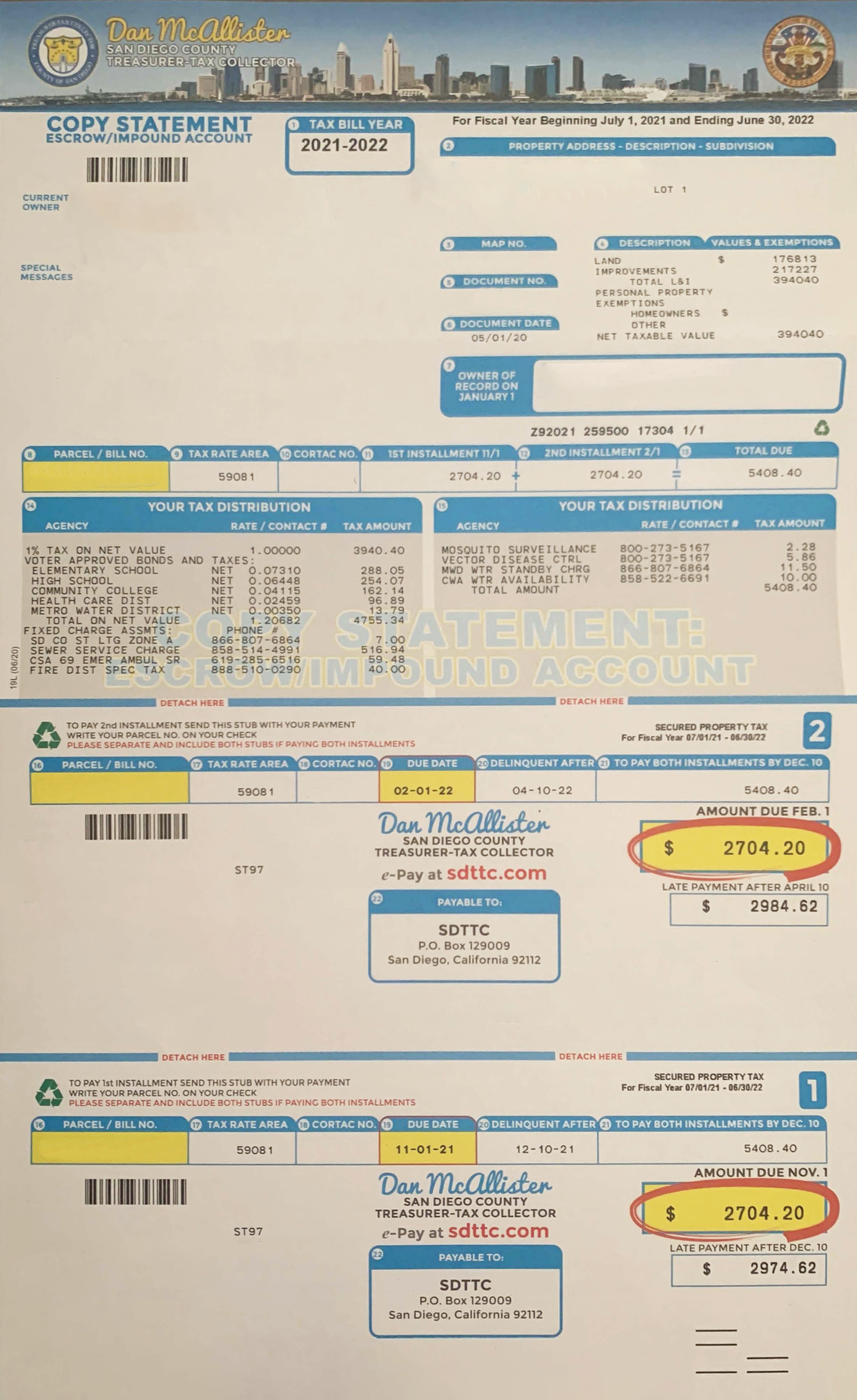

Escrow Pays:

The main thing to look out for is that the bill will clearly state that it is a Copy Statement and says Escrow/Impound Account (blue). You do not need to do anything with this bill. It will be paid by the Escrow company. The only exception to this is if you don’t impound your taxes, and you know who you are and what to do in that case :)

Categories

- All Blogs (408)

- Buying Myths (86)

- Demographic (16)

- Distressed Properties (2)

- Down Payments (5)

- Equity (1)

- First Time Home Buyers (114)

- Foreclosures (17)

- FSBO (10)

- Home Buying (266)

- Home Selling (205)

- Infographics (80)

- Interest Rates (55)

- Inventory (3)

- Investing (4)

- Move-Up Buyers (66)

- Pricing (74)

- Real Estate Market (209)

- Rent vs Buy (24)

- Resource (6)

- Selling Myths (73)

- Senior Market (2)

- Video (6)

Recent Posts

Why Right Now Might Be a Smart Time to Sell Your Home

Home Staging FAQ: What You Need To Know

The Big Difference Between Renter and Homeowner Net Worth

Renting vs. Buying: The Net Worth Gap You Need To See

Avoid These Top Homebuyer Mistakes in Today’s Market

The Benefits of Using Your Equity To Make a Bigger Down Payment

How Much Does It Cost To Sell My House?

Two Reasons Why the Housing Market Won’t Crash

The Top 3 Reasons Affordability Is Improving

Home Values Rise Even as Median Prices Fall

GET MORE INFORMATION